Latest Coverage

Latest Coverage for Subscribers Only

Access to the complete versions of our articles, research, and other resources are available to subscribers only. Get access now »

Where is the outbound foreign investment rule? What’s the delay?

As most Foreign Investment Watch readers know, President Biden issued an Executive Order to establish a targeted outbound investment review program back in August of 2023. Treasury issued its ANPRM on the same day, and the input process ended nearly seven months ago. So, um, where is it?

Report: Wall Street steered $6B to PRC companies; regulation next?

A long-awaited report from the House Select Committee says that U.S. financial services firms facilitated investment of more than $6.5 billion to 63 Chinese companies that the U.S. government had red-flagged or blacklisted. The Committee is now recommending legislation to regulate that activity.

“Regulationpalooza.” Readers offer their key takeaways from ACI event

For the last few years, we’ve crowdsourced ACI insights from our readers who attended the conference; after all, our readers are a lot smarter than us, and their observations are often more in touch with zeitgeist. Inside are the observations of several experts who were in attendance.

Advisor pens a CFIUS parable: “The party house and the guard dog”

Stephen Heifetz, one of our most outspoken Editorial Advisory Board members, does not mince words; he’s called the structure of CFIUS a “nightmare,” and has described the Committee’s machinery as “a long and painful grind.” He’s now penned a CFIUS parable we found impossible to withhold from publication.

CFIUS to increase max penalties to $5M, expand its use of subpoenas

The Treasury Department has proposed a rule that would “enhance certain CFIUS procedures” and sharpen its penalty and enforcement authorities. The proposed changes reflect the Committee’s evolution and increased focus on monitoring, compliance, and enforcement. Details are inside.

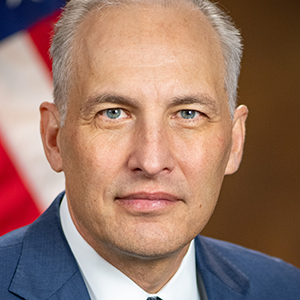

Former head of CFIUS on impact of proposed rule; key ACI takeaways

In the latest episode of our video series, “Ten With Tom,” former Assistant Secretary for Investment Security Thomas Feddo explains how the Treasury Department’s new rule proposal might lead to a more “adversarial” CFIUS, and offers insights on the new penalties and subpoena powers.

Treasury’s proposed budget: more CFIUS hiring, 15 FTEs for outbound

It’s budget season, and review of Departmental requests can offer a unique view of the year to come. For example, the Treasury Department has requested funding to hire 15 full-time employees to work on the outbound foreign investment review regime, which should begin “in earnest in FY 2025.”

Kansas bill would limit property owners from countries of concern

The Sunflower State (yes, that’s Kansas) is the latest to wade into the national security debate, following the lead of Florida, Missouri and others that have regulated foreign ownership of property. The Kansas move would prohibit certain purchases within 150 miles of any military installation. Details inside.

Canada foreign investment reviews strengthened for AI, other sectors

As expected, the Canadian government amended its Investment Canada Act, providing new tools to assess the national security risks of foreign investments. The “modernization” includes new pre-closing filing requirements in certain sectors, and increases penalties for non-compliance.

Exclusive conversation with the DoJ on new bulk personal data proposal

In our latest video conversation, we discuss the ANPRM on bulk sensitive personal data with Eric Johnson, Principal Deputy Chief of the DoJ’s Foreign Investment Review Section. We cover advisory opinions, overlap with CFIUS, timelines, and the “Four Knows” that every company should grasp.

Proposed DoJ budget includes data on reviews, NSAs, penalties, more

Buried inside the 67-page proposed fiscal year 2025 budget for the National Security Division was some interesting data on the number of new national security agreements in place, as well as insights on CFIUS penalties, site visits, monitoring of NSAs, and more. Details and the full report are inside.

DoJ has doubled prosecutors; says ANPRM rule will have “real teeth”

According to several senior Department of Justice officials, the DoJ has sharpened its focus and increased capacity when it comes to enforcement of sanctions and export controls. And enforcement of the bulk data ANPRM will have both investigative and subpoena authorities. Details inside.

Agriculture Dept. to remain “case by case” on CFIUS; gets more funding

Much has been made of the fact that the new Consolidated Appropriations Act adds the Secretary of Agriculture as a “permanent” member of CFIUS. But that’s misleading; in fact, the Act says that the Agriculture Secretary can be included as a member of CFIUS on a “case by case basis.” Insights inside.

Top advisors at nexus of national security and foreign investment

Congratulations to the experts who were selected as Foreign Investment Watch’s “Top Advisors 2024.” Out of hundreds of submissions, we selected 32 individuals based on myriad criteria, from experience and references to one-on-one interactions with Foreign Investment Watch.

President Biden issues Executive Order on sensitive personal data

As expected, Pres. Biden has issued an Executive Order aimed a protecting Americans’ sensitive personal data. The EO covers biometric, genomic, and geolocation data, and the DoJ has already published its proposed rule. Details, fact sheets, the EO, a related unclassified NSI report, more inside.

BIS wants insights for an upcoming rule on ICTS in “connected vehicles”

Last week, the Bureau of Industry and Security announced it was seeking feedback and insights on issues involving “information and communications technology and services” in connected vehicles that are developed or supplied by foreign adversaries. Details, the ANPRM and more are inside.

Talking CFIUS and the new “SCRC” with former DHS Asst. Secretary

Until a couple weeks ago, Bridget McGovern was Assistant Secretary for Trade and Economic Security at the Department of Homeland Security. We sat down with McGovern to play “true false,” and to discuss CFIUS, her new role, and the new “Supply Chain Resilience Center” we covered in December.

Court: Florida can’t prevent Chinese nationals from buying property

As we covered back in June, Florida had enacted a law banning foreign nationals from China and other “countries of concern” from purchasing certain real estate holdings. An appeals court has now prohibited enforcement of that ban. Details, the case, a DoJ statement of interest, the impact, and more inside.

White House updates its list of Critical and Emerging Technologies

The White House Office of Science and Technology Policy has released its updated list of Critical and Emerging Technologies. Last updated two years ago, the list has relevance to both export controls and foreign investment review policies. Details, the full list, and key changes from 2022 are inside.

Navy unveils new economic council to address foreign investment risks

Last week, Secretary of the Navy Carlos Del Toro unveiled the Maritime Economic Deterrence Executive Council, which will counter “adversarial economic activities” that directly impact the Navy and Marine Corps. Mitigation of foreign investment risks is part of the mandate. Details inside.